IRS Data Retrieval Tool Update

IRS Data Retrieval Tool will be available for the 2018-19 FAFSA®

On August 7, 2017, the IRS and Federal Student Aid (FSA) agreed to implement a solution that will reinstate the use of the IRS DRT beginning with the 2018–19 FAFSA®.

IRS Data Retrieval Tool unavailable for the 2017-18 FAFSA®

On March 10, 2017, the IRS and Department of Education announced the IRS Data Retrieval Tool on fafsa.gov and StudentLoans.gov is currently unavailable. Students and families should plan for the tool to be offline until the start of the next FAFSA® season. Students and parents completing a 2016–17 and 2017–18 FAFSA® should manually enter 2015 tax information (not 2016) into the FAFSA® application.

If you were selected for verification and you and/or your parent(s) (if applicable) did not use the IRS Data Retrieval Tool, you will need to provide us with a copy the 2015 Tax Return Transcript from the IRS.

If you have already completed verification for 2016-17 and/or 2017-18 you do not need to provide us with additional information.

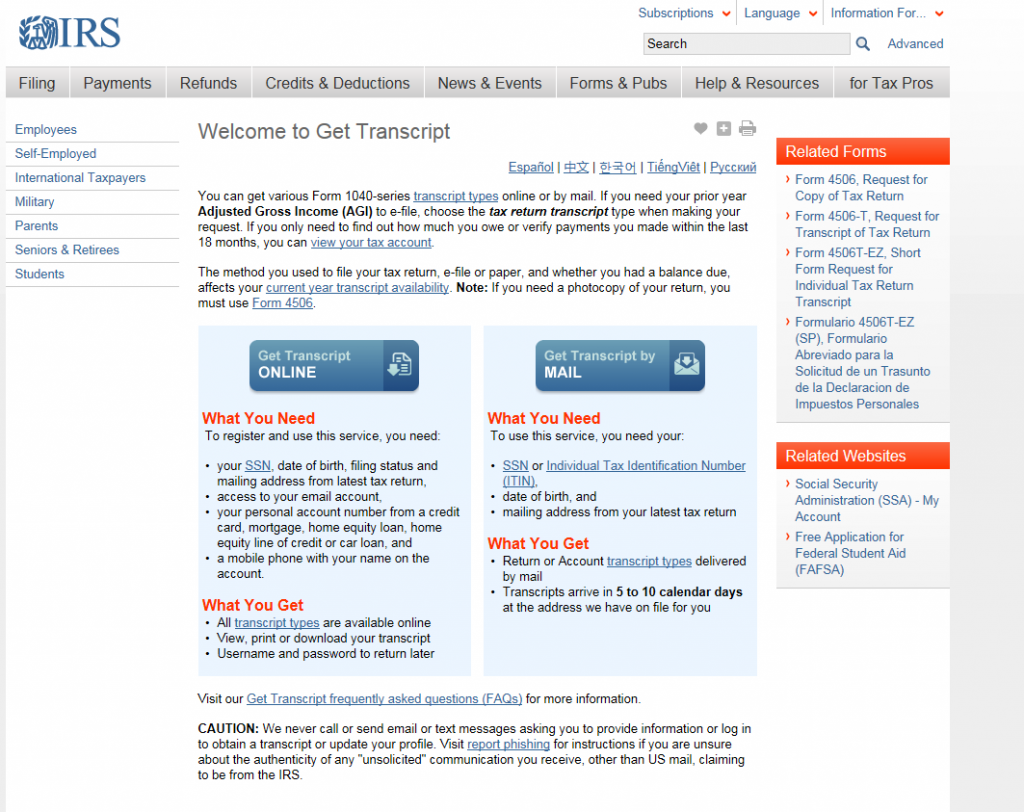

To get a tax return transcript visit: https://www.irs.gov/individuals/get-transcript

- Not everyone will be able to use the “Get Transcript Online” option.

- If you select the “Get Transcript by Mail” option, ensure that you enter the address that appeared on your 2015 federal tax return.

Make sure you request a Tax RETURN Transcript (NOT a Tax Account Transcript) and make sure you request the 2015 TAX YEAR (NOT the 2016 tax year).

If you’re having trouble getting your Tax Return Transcript, check out the IRS’s FAQs at https://www.irs.gov/individuals/get-transcript-faqs or call (800) 908-9946 for assistance.

For questions about Verification in general, email our office at finaid@wou.edu or call 503-838-8475.

Contact

Financial Aid Office

toll free 1-877-877-1593 | or e-mail: finaid@wou.edu |

Location: Administration Building, Room 310