Student Health & Counseling Center

Home » Resources » Student Health & Wellness » Financial Wellness » Credit

MenuFinancial Wellness

credit

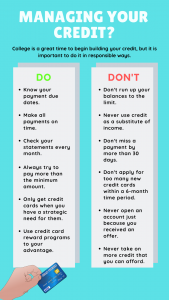

College is a great time for students to start building their credit, but it’s important to do it in responsible ways.

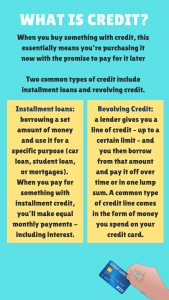

What Is Credit?

How Can I Start Building Credit?

- Start by getting a free copy of your credit report from one of the three credit reporting agencies.

- Equifax

- TransUnion

- Experian

- You can also request a free credit report each year by going to AnnualCreditReport.com.

- Once you have the report, start by checking the information and making sure it’s all correct. The report will also include recommendations on how to begin improving your credit.

- If you don’t have any credit history and you need to begin building it, there are a few easy ways to get started:

- Get a secured credit card: With a secured credit card, you make an upfront deposit, which is usually your credit limit. If you make a deposit of $1,000, you’ll have a credit limit of $1,000.

- After that, it works like a regular credit card. You use it to make purchases and then make on-time payments to build your credit score.

- Become an authorized user. Ask a friend or family member that has good credit if they could add you on a credit card as an authorized user.

- The catch is that your friend will be on the hook to pay for anything you charge and if his credit declines, this can also negatively affect your credit score.

- Apply for a store card. This might be easier to qualify for. A store credit card is typically one that you are only able to use while shopping at that particular company.

- But, be aware! Store credit cards often come with higher interest rates, so it is important to pay off your balance each month.

- Get a secured credit card: With a secured credit card, you make an upfront deposit, which is usually your credit limit. If you make a deposit of $1,000, you’ll have a credit limit of $1,000.

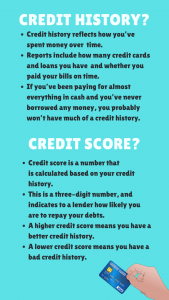

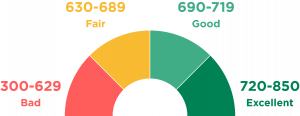

What is a good credit score?

- For a score with a range between 300-850, a credit score of 700 or above is generally considered good.

- A score of 800 or above on the same range is considered to be excellent.

- Most credit scores fall between 600 and 750.

- Higher scores represent better credit decisions and can make lenders more confident that you will repay your future debt.

Here are some tips for managing credit cards:

Loans:

Getting a loan just to build credit is generally not a good idea, as you shouldn’t take on debt only for the sake of your credit score. But if you have a valid reason, such as needing a car for college, a small loan in your name can help you build credit.

However, just like credit cards, loans will only build credit if you pay them on time every month. If you also have a credit card, getting a loan will help with the account mix factor of your credit score.

Summary:

It is important to get established with some sort of credit history. It makes it possible to get approved for housing, loans, and other things down the road. However, it’s more important to gain a positive credit history. To do this, you must be responsible with the types of accounts you open, the debt you accrue, and your payment history.